41 what is coupon payment of a bond

Bond Coupon Interest Rate: How It Affects Price A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's... Coupon Rate Definition - investopedia.com The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

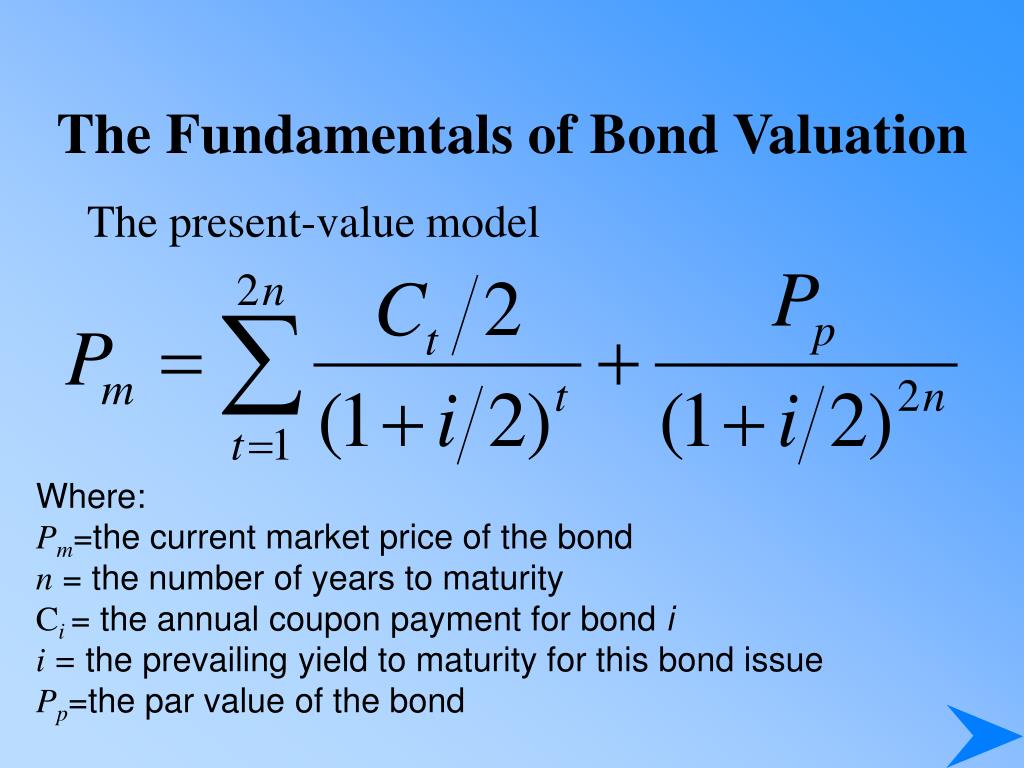

Basics Of Bonds - Maturity, Coupons And Yield A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually.

What is coupon payment of a bond

Russia set to avoid default as creditors get bond payment ... Russia was due to pay some $650 million on April 4; ... announcing it had paid nearly $650 million it owed in coupons and principal to holders of the bonds, ahead of a grace period expiry on May 4 Russia aims to avert historic debt default with last-ditch ... Historic default. Russia appeared to have averted a historic bond default in March, fulfilling interest payments worth $117 million on two dollar-denominated sovereign eurobonds after speculation ... What Is the Coupon Rate of a Bond? A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

What is coupon payment of a bond. Coupon Rate Calculator | Bond Coupon The annual coupon payment is the product of the two, as seen in the formula below: annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. What Is a Coupon Payment? - Smart Capital Mind A coupon payment is a payment made to the holder of a bond for the interest that bond accrues while it is maturing. This is typically made as a semi-annual payment, so only half of the interest owed on the bond is paid at a time. I Bonds Set to Pay 9.62% Through October - The New York Times An I bond rate has two parts: a fixed rate, set when the bond is issued, which stays the same for its 30-year life, and a variable rate, which is based on the six-month change of the Consumer ... Bond definition - AccountingTools Bonds usually include a periodic coupon payment, and are paid off as of a specific maturity date. There are a number of additional features that a bond may have, such as being convertible into the stock of the issuer, or callable prior to its maturity date. The Difference Between a Registered Bond and a Coupon Bond

Coupon Payment Calculator The coupon payment is the interest paid by a bond issuer to a bondholder at each payment period until the bond matures or it is called. The payment schedule can be quarterly, semiannually or annually, depending on the agreed time. When a bond is first issued, the bond's price is its face value. Coupon bond definition — AccountingTools A coupon bond has interest coupons that the bond holder sends to the issuing entity or its paying agent on the dates when interest payments are due. Interest payments are then made to the submitting entity. The interest coupons are normally due on a semi-annual basis. A coupon bond is unregistered, so the issuing entity has an obligation to pay ... I Bonds are Set to Pay 9.6% In Annual Interest Through ... On Monday, the Treasury announced that Series I savings bonds, an inflation-protected investment backed by the US government, will pay 9.62% interest through October 2022. Russia swerves to avoid default: what is next? | Euronews 2) Russia faces coupon payments due on May 27 on a dollar bond issued in 2016 and an euro bond issued in 2021. The payment on the euro bond could be done in rouble as a last resort, but the dollar ...

Bond Basics: Issue Size and Date, Maturity Value, Coupon The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. All the 21 Types of Bonds | General Features and Valuation ... Coupon. The rate of interest paid on the bond is called a coupon. (Read more about it at Coupon Rate).. Rating. Credit rating agencies usually rate every bond; the higher the credit rating, the lower the coupon required to pay by the issuer and vice versa.. Coupon Payment Frequency. The coupon payments on the bond usually have a payment frequency. Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)... Coupon Rate - Meaning, Calculation and Importance Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. Coupon Rate = (Total Annual Interest Payments / Face Value of the Bond) * 100 Let's understand couponrate calculation with the help of an example.

Difference Between Coupon Rate and Interest Rate (With ... A coupon rate is a fixed payment of the bond, and the maturity period is issued by the holder at the initial stage of issuing the bond. It varies according to the bondholders of the bond—for instance, a 5-year bond period. ... Firstly, it is the zero-coupon bonds. They don't have any coupon payment for the bondholder to pay for. Also, it is ...

Russia looks to avoid default after bond payments sent to ... Attention is now shifting to upcoming payments with Russia due to pay coupons on May 27 on a dollar-denominated bond issued in 2016 and a euro-denominated bond issued in 2021. That payment is due after a temporary license issued by the U.S. Office of Foreign Assets Control (OFAC) and allowing transactions related to debt payments by the Russian ...

What Is the Coupon Rate of a Bond? A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Russia aims to avert historic debt default with last-ditch ... Historic default. Russia appeared to have averted a historic bond default in March, fulfilling interest payments worth $117 million on two dollar-denominated sovereign eurobonds after speculation ...

Russia set to avoid default as creditors get bond payment ... Russia was due to pay some $650 million on April 4; ... announcing it had paid nearly $650 million it owed in coupons and principal to holders of the bonds, ahead of a grace period expiry on May 4

Post a Comment for "41 what is coupon payment of a bond"