42 zero coupon bond semi annual calculator

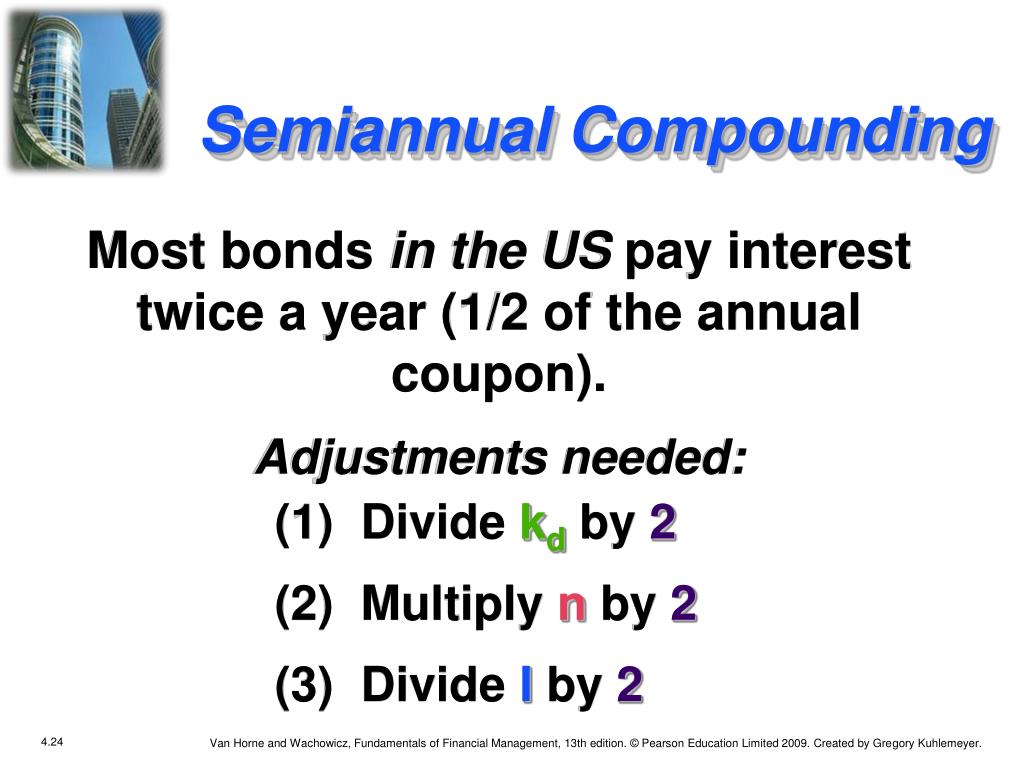

Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Zero-Coupon Bond Value Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods Zero Coupon Bond Value Calculator To use this online calculator for Zero Coupon Bond Value, enter Face Value (F), Rate of Return (RoR) & Time to Maturity (T) and hit the calculate button. Here is how the Zero Coupon Bond Value calculation can be explained with given input values -> 0.000102 = 1000/ (1+4)^10. FAQ What is Zero Coupon Bond Value?

Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero coupon bond semi annual calculator

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... Bond Yield Definition - Investopedia Jan 01, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Zero Coupon Bond Value Calculator » Platformus Zero Coupon Bond Value Calculator Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2

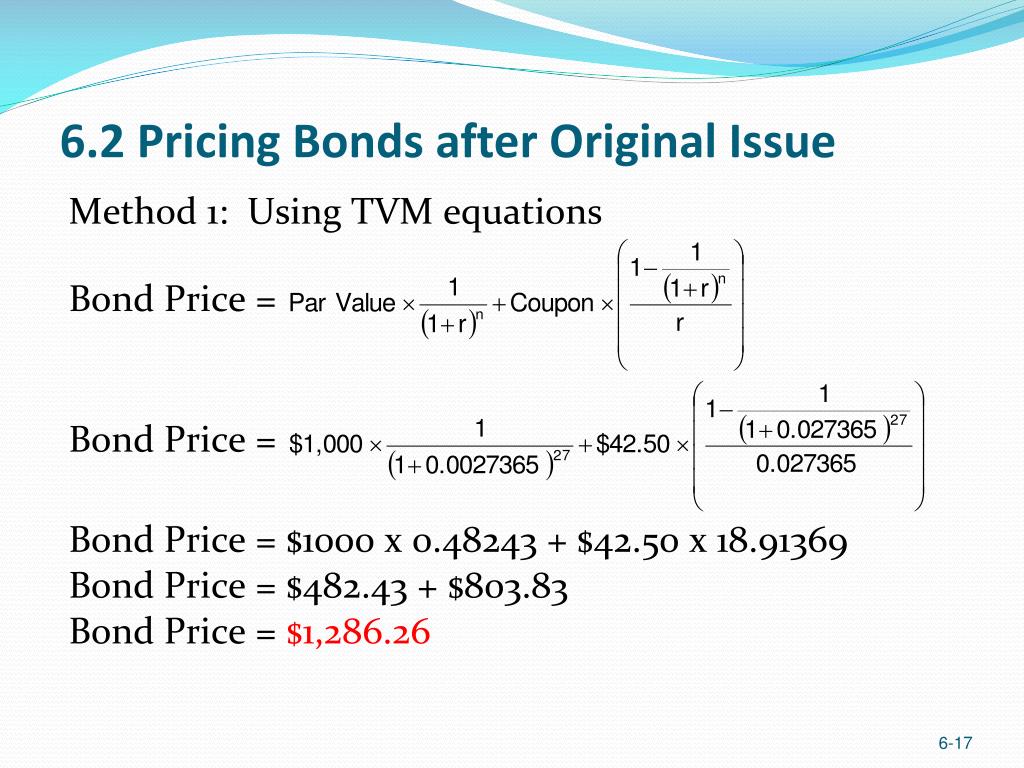

Zero coupon bond semi annual calculator. Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter So, when we calculate the semi-annual bond payment, first of all, we have to get 2% of the face value of $1,000, which is $20, and after that, we have to divide it by two. The bond, therefore, pays $10 semi-annually. When we divide $10 by the current price of $900, then the semi-annual bond yield will be obtained, which is 1.1%. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Bond Formula | How to Calculate a Bond | Examples with Excel ... Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

Zero Coupon Bond Calculator Zero Coupon Bond Formula. The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t. where ZCBV is the zero-coupon bond value. F is the face value of the bond. r is the yield/rate. t is the time to maturity. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest. Compound Interest Compound interest is ... Zero-Coupon Bonds: Definition, Formula, Example ... - CFAJournal In the case where the bonds offer semi-annual compounding the following formula is used to calculate the price of the bond: Price = M / (1 + r/2) ^ n*2 Examples of Zero-Coupon Bonds Calculating the price of zero-coupon bonds varies on whether the bonds offer annual compounding or semi-annual compounding. How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

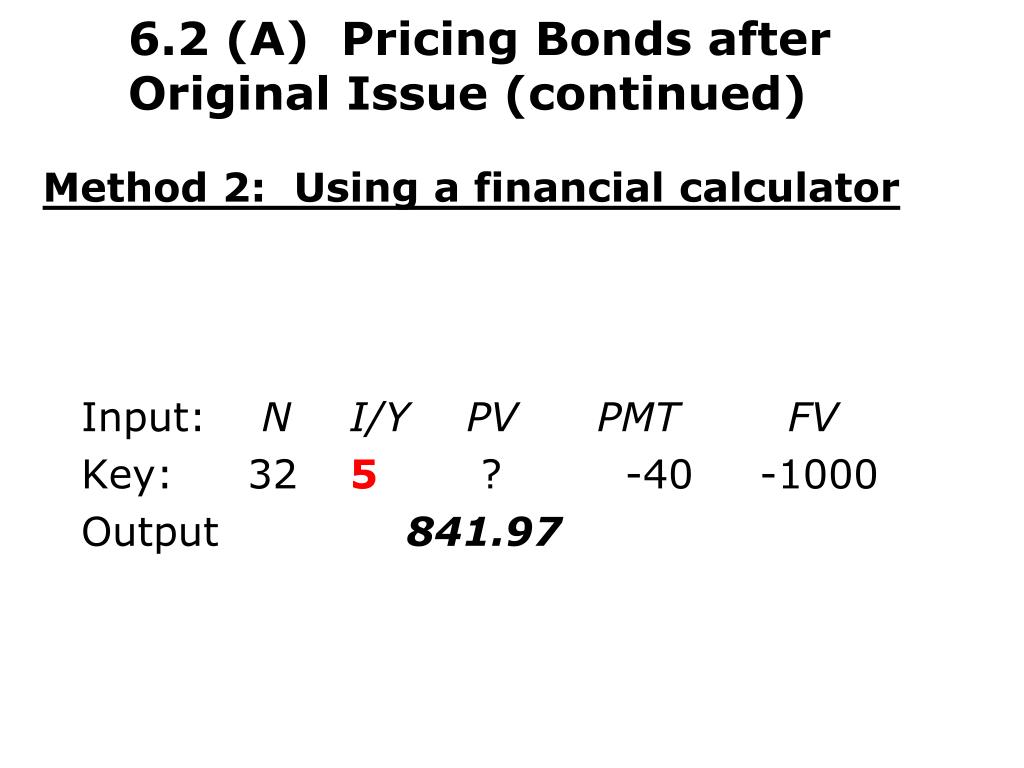

What is the price of a 5-year, $1,000 bond that pays 6% ... Answer (1 of 7): The easiest way to do this question is to use a financial calculator with the following inputs: N= 10 [this is because 5 years x 2 (to account for semi annual)] i/y = 2.5 [5% / 2 (periods per year) = 2.5] PMT = 30 [(.06 coupon x 1000 face value) / 2 = 30] FV = +1000 Compute P... Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Bond price formula - Excelchat | Excelchat This article will show us how to calculate the bond value or bond price for a zero coupon bond, an annual coupon bond and a semi-annual coupon bond. Figure 1. Final result: Bond price formula. Calculate bond price. Bond price is the current discounted value of a future cash flow. How to calculate bond price in Excel? - ExtendOffice In this condition, you can calculate the price of the semi-annual coupon bond as follows: Select the cell you will place the calculated price at, type the formula =PV (B20/2,B22,B19*B23/2,B19), and press the Enter key. Note: In above formula, B20 is the annual interest rate, B22 is the number of actual periods, B19*B23/2 gets the coupon, B19 is ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

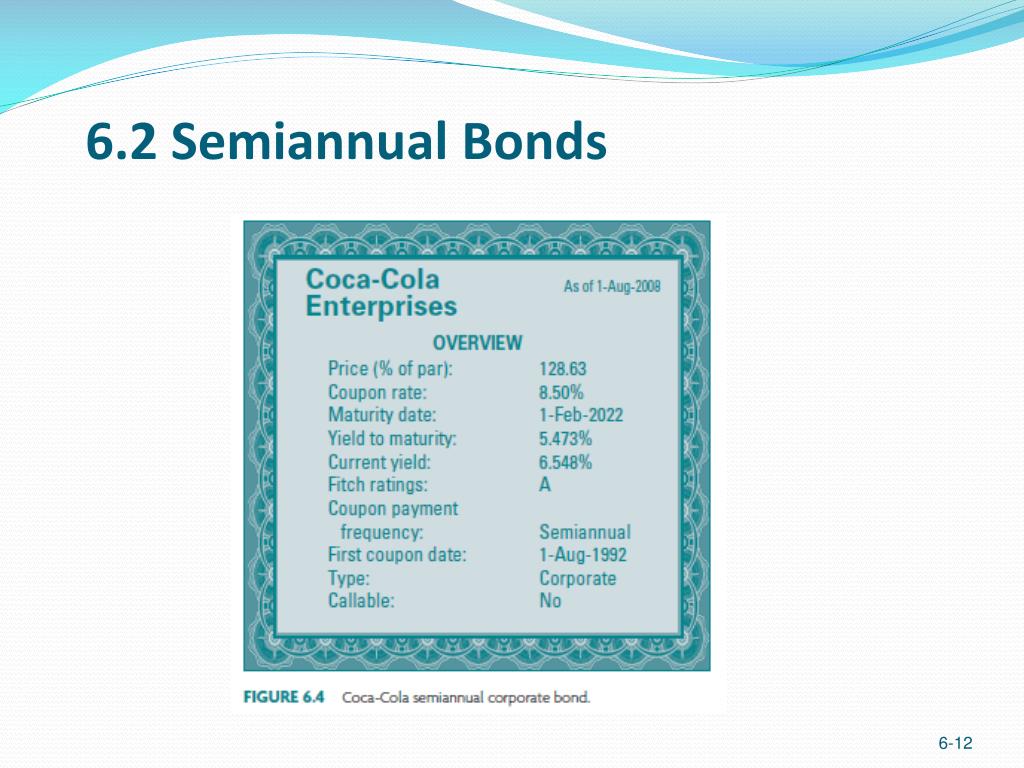

Bond Yield to Maturity Calculator for Comparing Bonds So, a 10% coupon on a $10,000 bond would pay an annual interest of $1000. Again, these payments are often staggered throughout the year, so a bond holder's interest might be paid in biannual or quarterly installments. Fixed Rate Bonds – A fixed rate bond has a coupon that represents a fixed percentage of its par value.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ Zero Coupon Bond Calculator Inputs Bond Face Value/Par Value ($) - The face or par value of the bond - essentially, the value of the bond on its maturity date. Annual Interest Rate (%) - The interest rate paid on the zero coupon bond. Years to Maturity - The numbers of years until the zero coupon bond's maturity date.

Price of a Zero coupon bond - Calculator - Finance pointers August 20, 2021 | 0 Comment | 9:15 pm. The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below insert the values of Face value / Maturity ...

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3.

Post a Comment for "42 zero coupon bond semi annual calculator"