43 zero coupon bond face value

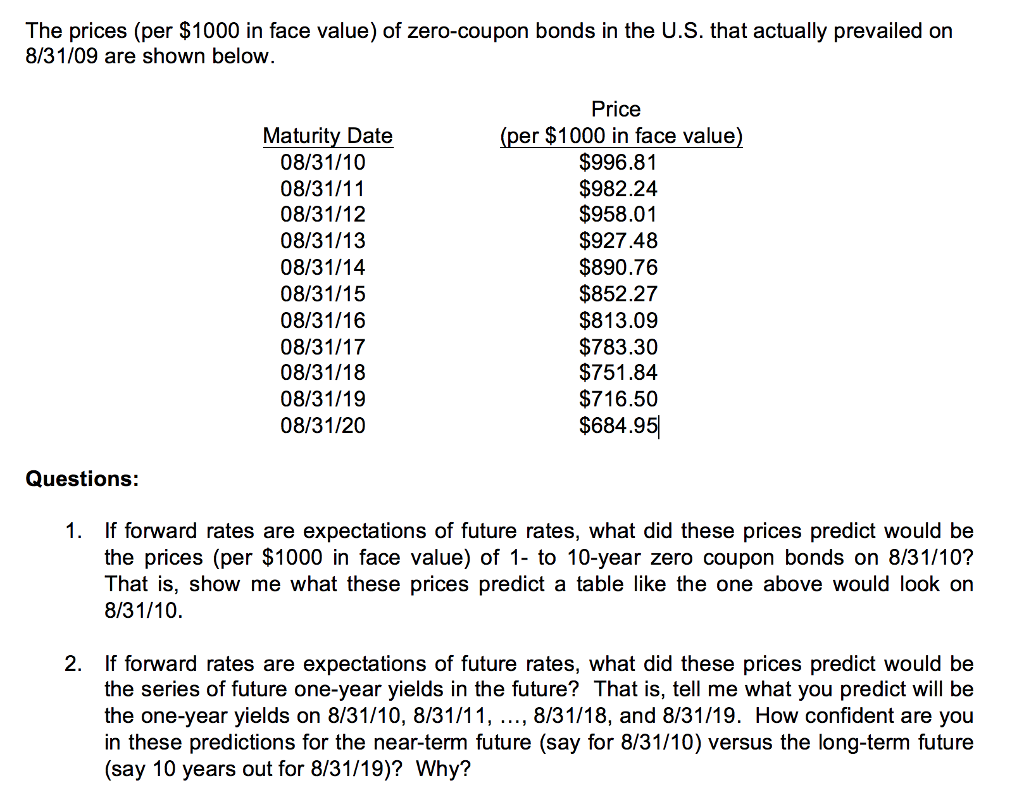

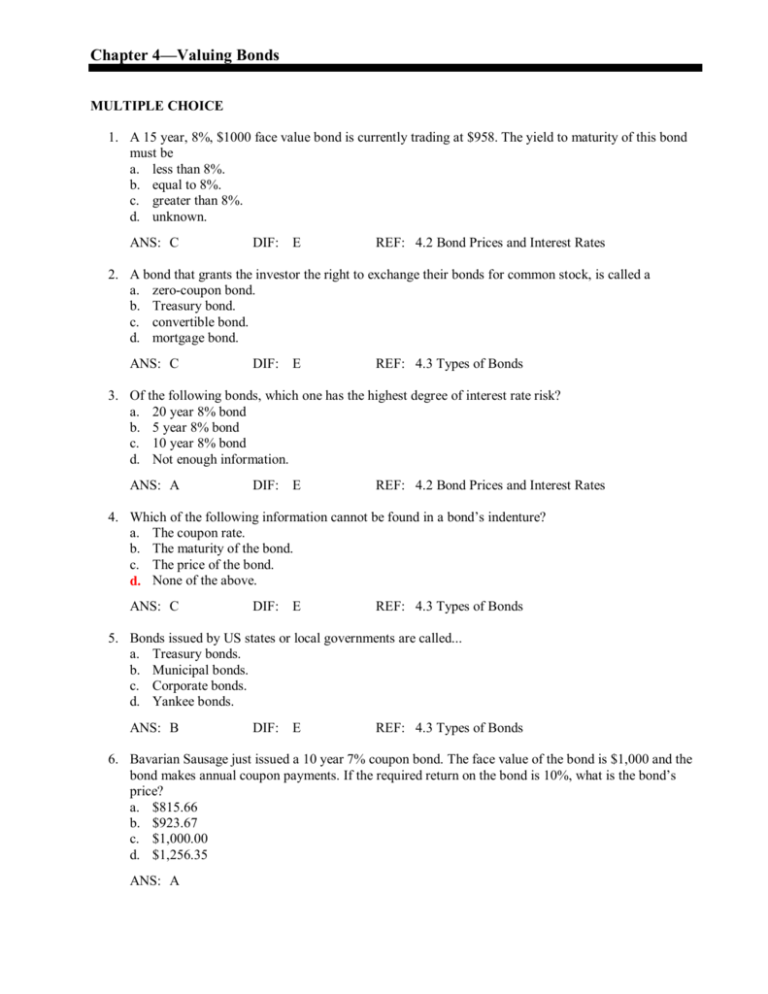

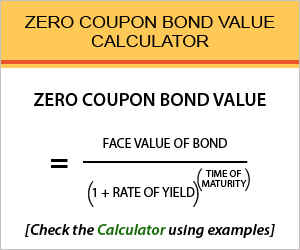

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation. What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

Zero Coupon Bond Definition and Example | Investing Answers Let's say you wanted to purchase a zero-coupon bond that has a $1,000 face value, with a maturity date three years from now. You've determined you want to earn 5% per year on the investment. Using the formula above you might be willing to pay: $1,000 / (1+0.025)^6 = $862.30

Zero coupon bond face value

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. Value and Yield of a Zero-Coupon Bond | Formula & Example Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period = $55,317 − $50,000 = $5,317 Zero-Coupon Bonds: Definition, Formula, Example ... - CFAJournal Mr. Tee is looking to purchase a zero-coupon bond that has a face value of $50 and has 5 years till maturity. The interest rate on the bond is 2% and will be compounded annually. In the scenario above, the face value of the bond is $50. However, to calculate the price that needs to be paid for the bond today, the following formula is used:

Zero coupon bond face value. Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3. Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = Face Value / (1+ interest rate/2) ^ time to maturity*2 Price of Zero-Coupon Bond = $10,000 / (1.025) ^ 20 = $6,102.77 With semiannual compounding, we see the bond... Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Solved A zero-coupon bond with face value $1,000 and | Chegg.com A zero-coupon bond with face value $1,000 and maturity of six years sells for $745.22. a. What is its yield to maturity? (Round your answer to 2 decimal places.) Yield to maturity % b. The One-Minute Guide to Zero Coupon Bonds | FINRA.org the value of your zero-coupon bond on the secondary market will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. How Do Zero Coupon Bonds Work? - SmartAsset When the bond matures, the bondholder is repaid an amount equal to the face value or par value of the bond. Bonds are sometimes issued at a discount below its par value. For example, if you buy a bond at a discount for $940, the par value may still be $1,000. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) compute the price of a 90-day zero coupon bond with a face value of ... compute the price of a 90-day zero coupon bond with a face value of $100 if the market yield is 6 percent. Unless indicated otherwise, assume that 1 year = 365 days, and that interest is compounded annually. and the textbook answer is = 100/(1+0.06*90/365) I thought it should be 100/(1+0.06/365)^90.

Zero Coupon Bond | Definition, Formula & Examples - Study.com Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 = $990.44 Zero-Coupon Bond vs Coupon Bond:

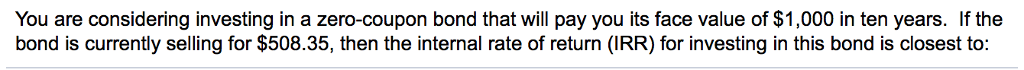

Solved A zero coupon bond with a face value of $1,000 is | Chegg.com A zero coupon bond with a face value of $1,000 is issued with an initial price of $410.50. The bond matures in 25 years. What is the implicit interest, in dollars, for the first year of the bond's life? Use semiannual compounding. Expert Answer 100% (4 ratings) Calculation of implicit interest: PV = $410.5 … View the full answer

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Zero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face ...

The table below provides the market prices of | Chegg.com The table below provides the market prices of zero-coupon bonds of various maturities; each bond has a face value of $100. Price Maturity $90.91 1 year $81.90 2 years $73.12 3 years A three-year bond is trading in the same market as these zero-coupon bonds; the cash flows of this bond are identical. Question: The table below provides the market ...

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting That is the charge paid for the use of the money that was borrowed. The price reduction below face value can be so significant that zero-coupon bonds are sometimes referred to as deep discount bonds. To illustrate, assume that on January 1, Year One, a company offers a $20,000 two-year zero-coupon bond to the public. A single payment of $20,000 ...

What is Zero-Coupon Bond - garvthakur.com The term "Zero-coupon bond" is also known as discount bond, accrual bond or deep discount bond which do not pay any interest during the life of the bonds but they do reach at full maturity at a certain point. Investors buy zero coupon bonds at a low discount from their face value. The maturity dates on zero coupon bonds are usually long-term for ten, fifteen, or more years. These long-term ...

Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Zero Coupon Bond Value Calculator - buyupside.com Zero Coupon Bond Value Calculator Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 Related Calculators Bond Convexity Calculator

Post a Comment for "43 zero coupon bond face value"