45 coupon rate vs ytm

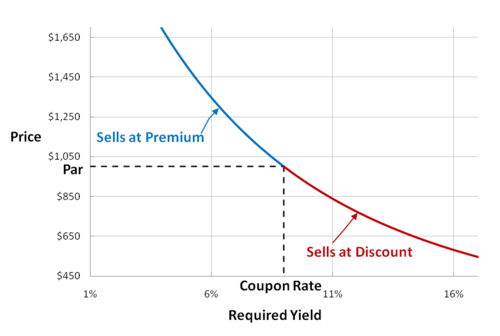

Coupon Rate and Yield to Maturity | How to Calculate ... - YouTube Jun 14, 2018 ... The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated ... Bond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Measured as a percentage change (in price) per percentage change in interest rate. Bond Convexity - Measure of the "curvedness" or degree of curve the bond's price would take at different interest rates. Graph Output; Optionally, if you click the "Draw Price vs. Yield Graph", the tool will show the estimates change in price if the market yield ...

Perpetuity: What is a Perpetuity? - Wall Street Prep The denominator is equal to the discount rate subtracted by the growth rate. Present Value (PV), Growth = $102 / (10% – 2%) = $1,275 From our example, we can see the positive impact that growth has on the value of a perpetuity, as the present value of the growing perpetuity is $275 more than that of the zero-growth perpetuity.

Coupon rate vs ytm

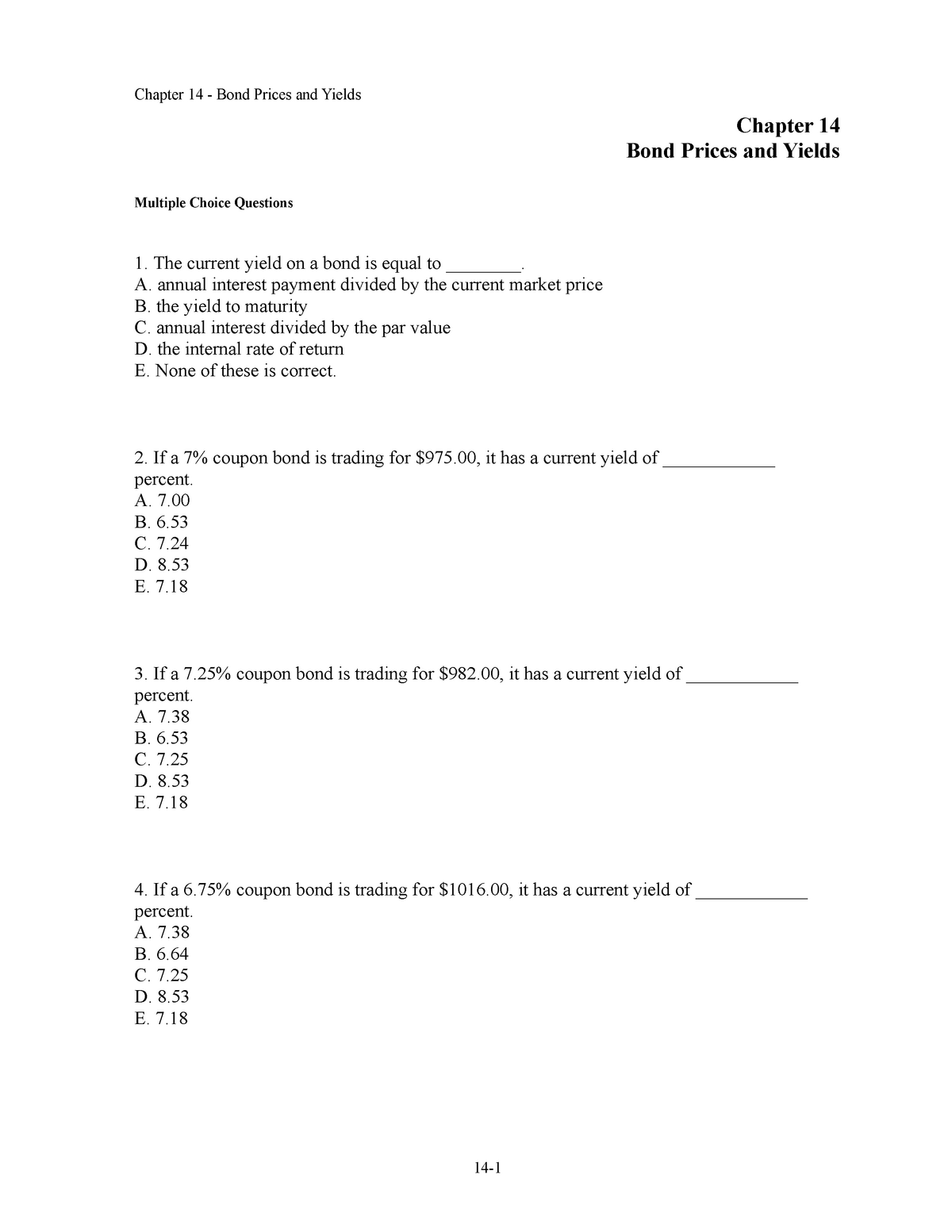

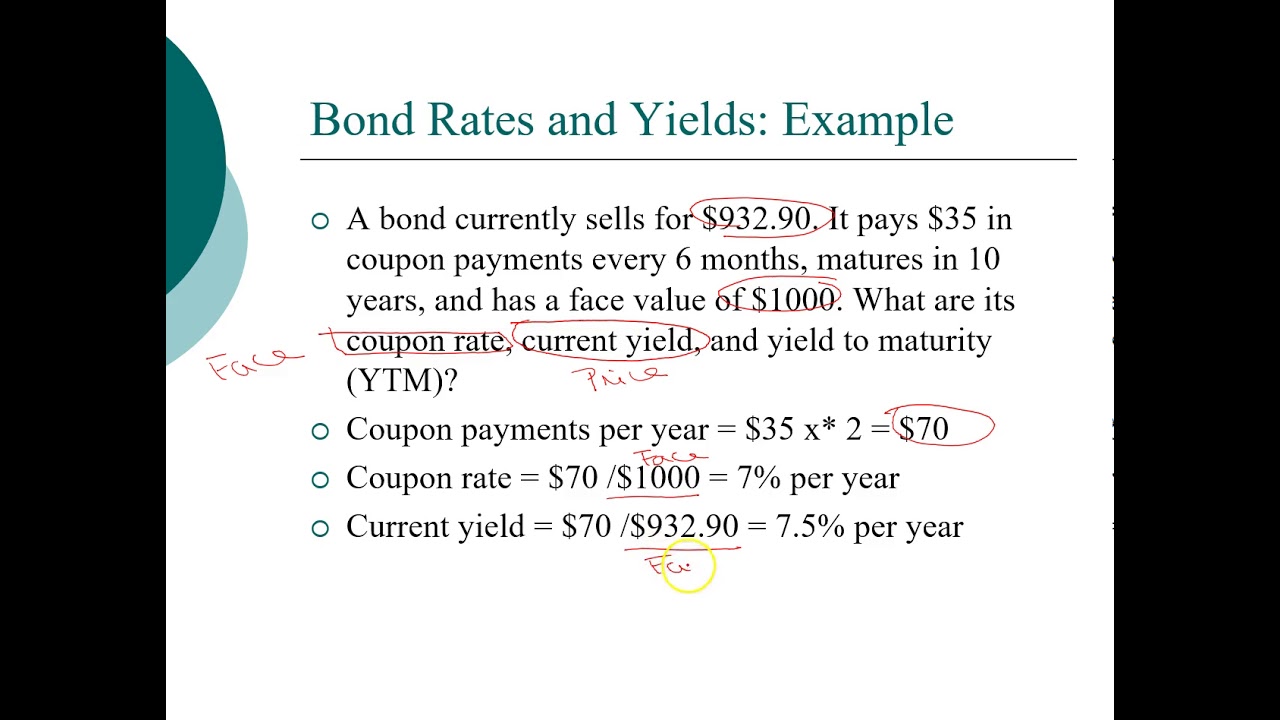

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube Aug 3, 2021 ... In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield ... Yield to Maturity (YTM) - Overview, Formula, and Importance May 07, 2022 · The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and coupon payments are made in a timely fashion. How YTM is Calculated. YTM is typically expressed as an annual percentage rate (APR). It ... Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per ...

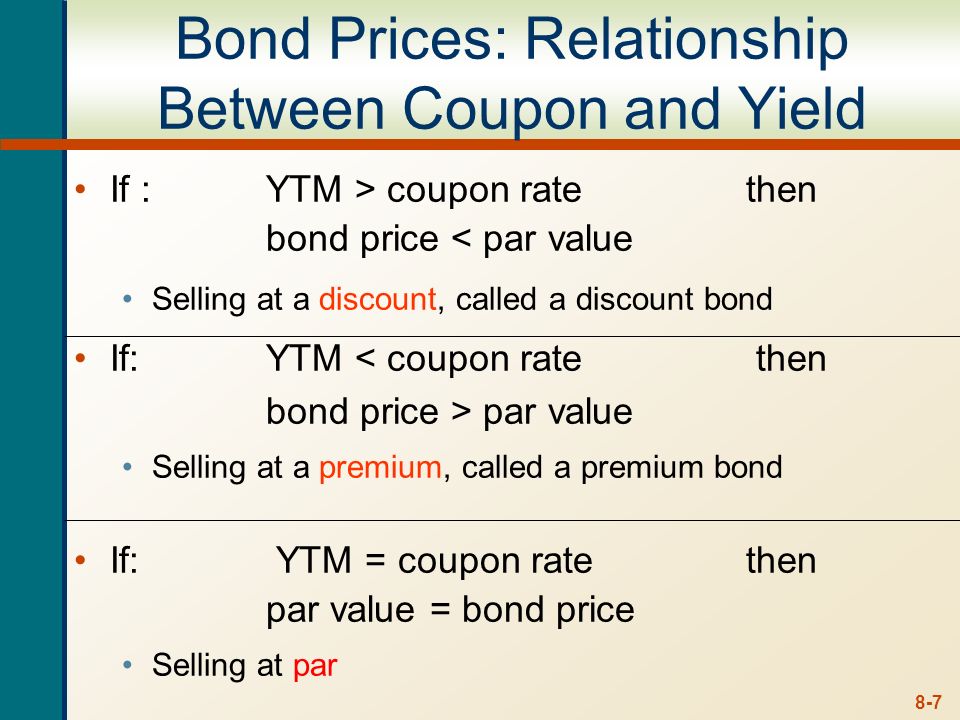

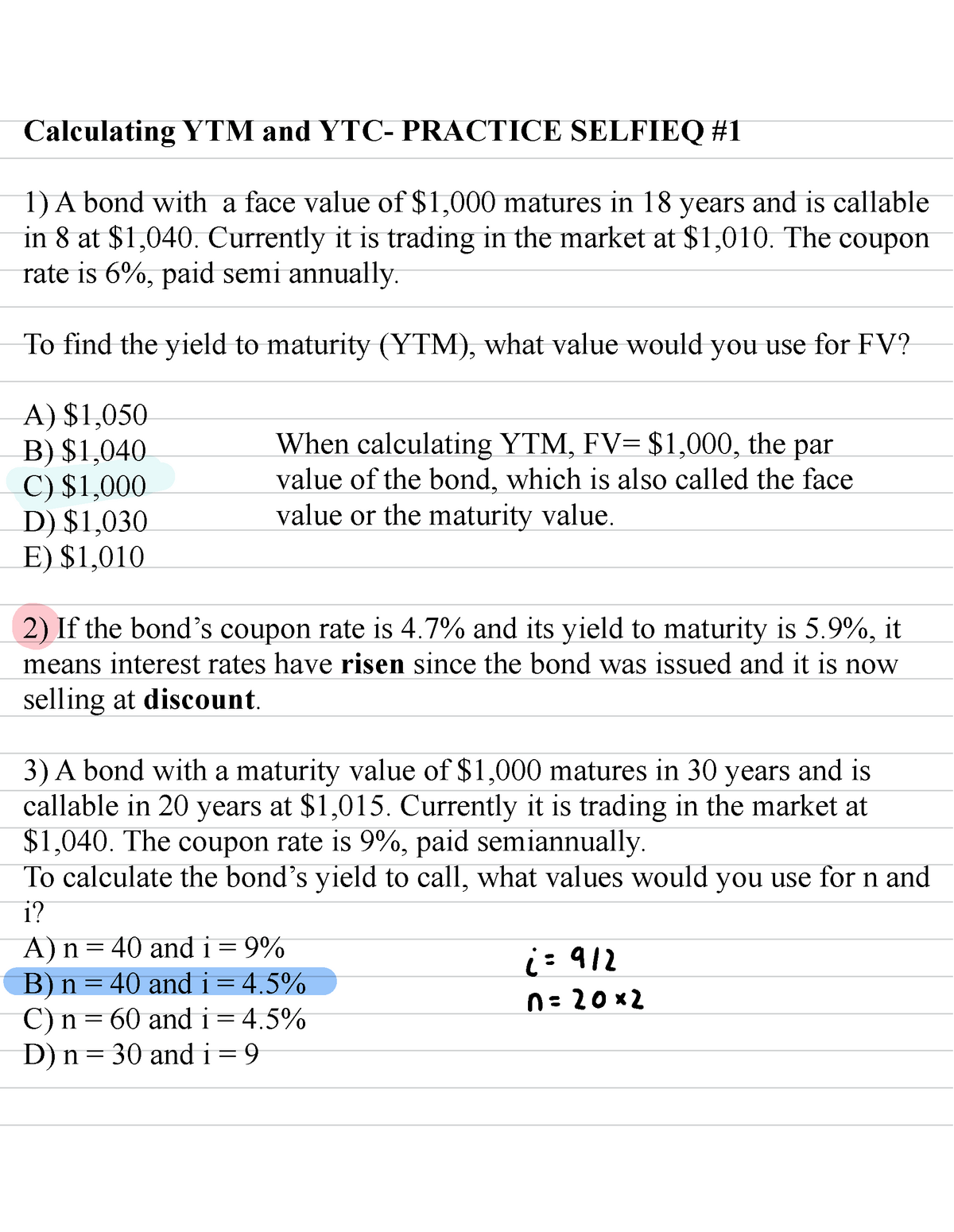

Coupon rate vs ytm. Perpetuity: What is a Perpetuity? - Wall Street Prep The denominator is equal to the discount rate subtracted by the growth rate. Present Value (PV), Growth = $102 / (10% – 2%) = $1,275 From our example, we can see the positive impact that growth has on the value of a perpetuity, as the present value of the growing perpetuity is $275 more than that of the zero-growth perpetuity. Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... When is a bond's coupon rate and yield to maturity the same? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ... Yield to Maturity vs. Coupon Rate: What's the Difference? 20/05/2022 · Yield to Maturity vs. Coupon Rate: An Overview When investors consider buying bonds they need to look at two vital pieces of information: the yield to maturity (YTM) and the coupon rate.

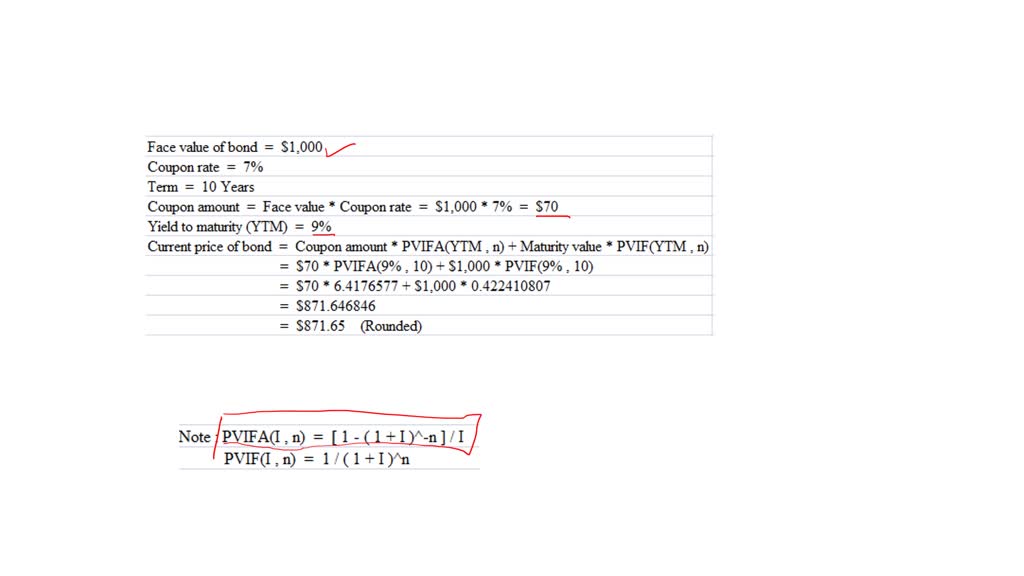

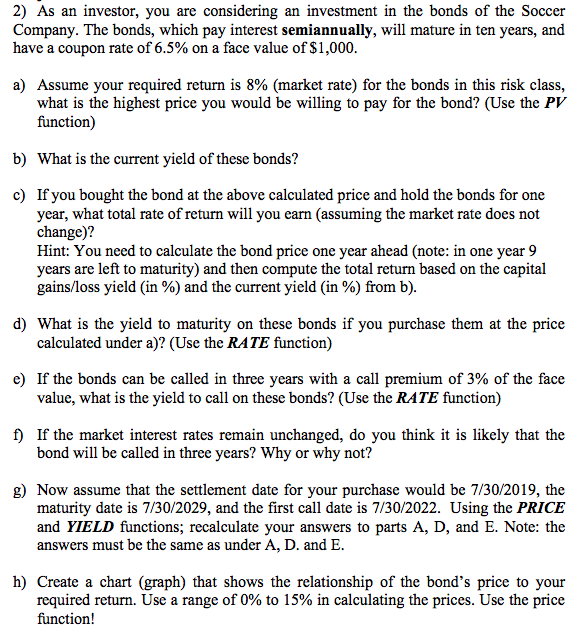

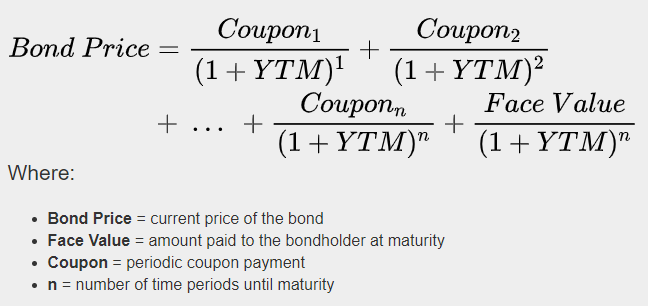

Coupon vs Yield | Top 5 Differences (with Infographics) The yield to maturity of a bond is the interest rate for a bond, which is calculated on the basis of coupon payment and the current market price of a bond. Yield to Maturity (YTM) - Overview, Formula, and Importance 07/05/2022 · Yield to Maturity (YTM) – otherwise referred to as redemption or book yield – is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and … Bond Formula | How to Calculate a Bond - EDUCBA Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if … The Difference Between Coupon and Yield to Maturity - The Balance Mar 4, 2021 ... To put all this into the simplest terms possible, the coupon is the amount of fixed interest the bond will earn each year—a set dollar amount ...

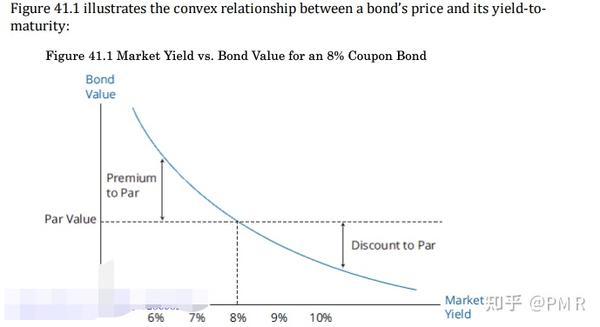

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year, whereas yield of maturity ... Difference between Coupon Rate And Yield To Maturity - Angel One Another difference between these two metrics is that the YTM represents the average rate of return that an investor is likely to experience over the bond's ... Relationships among a Bond's Price, Coupon Rate, Maturity, and ... Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity, and Market Discount Rate (Yield-to-Maturity) · A bond's price moves inversely with its YTM ... Bond Formula | How to Calculate a Bond | Examples with Excel ... Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Yield to Maturity (YTM): What It Is, Why It Matters, Formula 31/05/2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Annual Coupon Rate (%) - The annual interest rate paid on the bond's face value. Coupon Payment Frequency - How often the bond pays out interest every year. Calculator Outputs. Yield to Maturity (%): The yield you'd recognize holding the bond until maturity (assuming you receive all payments). Macaulay Duration (Years) - Weighted average time (in years) for a payout from …

OID: What is an Original Issue Discount? - Wall Street Prep Coupon Bonds: While coupon bonds pay out interest regularly, they can still carry an OID if the coupon is deemed too low relative to comparable investments. Whether there are no coupons or relatively low coupons paid, the discounted issuance price positively impacts bondholder returns (e.g. yield to maturity) OID Accounting Treatment

Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per ...

Yield to Maturity (YTM) - Overview, Formula, and Importance May 07, 2022 · The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and coupon payments are made in a timely fashion. How YTM is Calculated. YTM is typically expressed as an annual percentage rate (APR). It ...

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube Aug 3, 2021 ... In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield ...

![Solved] 2)Colliers Concord Ltd. has recently issued a bond ...](https://www.cliffsnotes.com/tutors-problems/assets/img/attachments/24859591.jpg)

Post a Comment for "45 coupon rate vs ytm"