42 how to determine coupon rate

How To Determine A Discount Rate Coupon, Coupon or Promo Codes Big coupon code, coupon code, promotion code, discount code. 159.223.93.251 . Coupons Codes; Promo Codes; Top Deals; Top Searched; Top Stores; Coupons Codes; ... How To Determine A Discount Rate. 6.98%. OFF. How to calculate Discount Rate with Examples - EDUCBA achieverpapers.comAchiever Papers - We help students improve their academic ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

How to Measure the ROI of Discount Coupons? - Voucherify Redemption rate, as you may expect, is a ratio of people that actually used the promo code. You can calculate it with this simple formula: Number of redeemed coupons / Number of published coupons x 100.

How to determine coupon rate

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if... How To Determine The Discount Rate Coupon, Coupon or Promo Codes Big coupon code, coupon code, promotion code, discount code. 159.223.93.251 . Coupons Codes; Promo Codes; Top Deals; Top Searched; Top Stores; Coupons Codes; ... How To Determine The Discount Rate; How To Determine The Discount Rate. OFF. Assignment Essays - Best Custom Writing Services › work-usaid › resources-for-partnersINDIRECT COST RATE GUIDE FOR NON-PROFIT ORGANIZATIONS Determine Indirect Cost Rate Structure: Determine which method is best for the organization, i.e., direct cost allocation or simplified, and whether special indirect cost rates are required, i.e. on-site, off-site, fringe benefit rate for full-time vs. part-time. In selecting the appropriate method, the organization should consider the following:

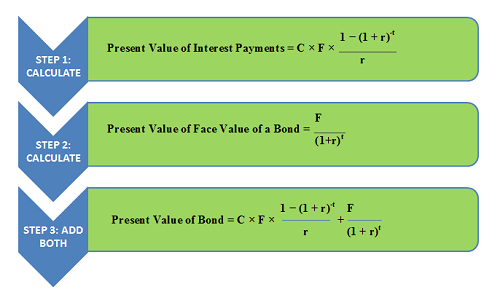

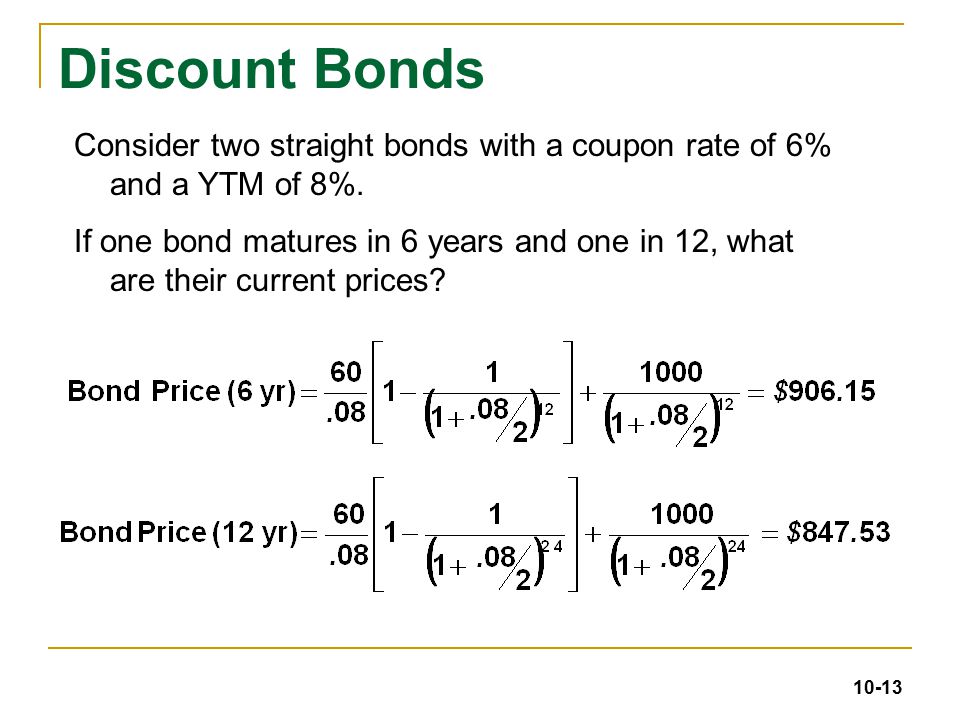

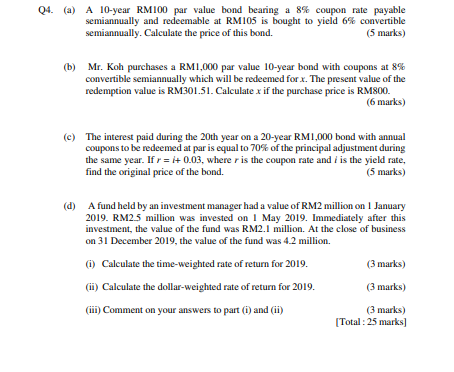

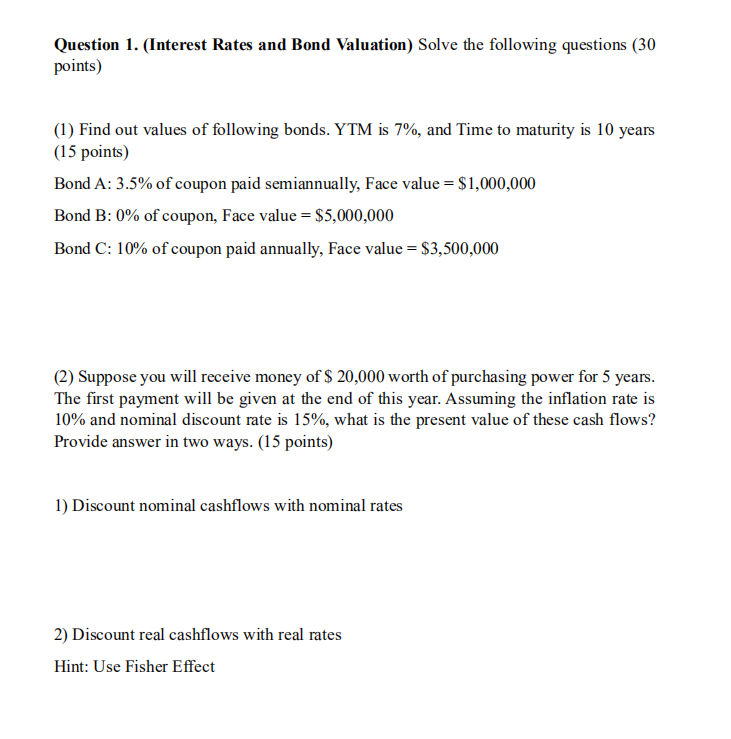

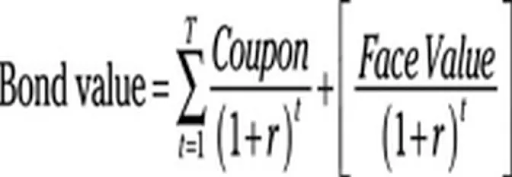

How to determine coupon rate. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 › 2022/10/12 › 23400986Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ... What Is Coupon Rate and How Do You Calculate It? A bond's coupon price could be calculated by dividing the sum of the safety's annual coupon payments and dividing them by the bond's par worth. For instance, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with larger coupon rates are extra desirable for ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder.

› fintech › cfpb-funding-fintechU.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah. › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo As per the given question, Par value of bond = $1,000. Annual interest payment = 4 * Quarterly interest payment. = 4 * $15. = $60. Therefore, the coupon rate of the bond can be calculated using the above formula as, Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount. › publications › p550Publication 550 (2021), Investment Income and Expenses ... Special rules to determine amounts payable on a bond. Basis. Dealers. How To Figure Amortization. Constant yield method. Step 1: Determine your yield. Step 2: Determine the accrual periods. Step 3: Determine the bond premium for the accrual period. Special rules to figure amortization. Bonds Issued Before September 28, 1985. Straight-line method.

How To Find Coupon Rate Of A Bond On Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator.

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow Step 1, Get the bond's face value. The first piece of information is the actual face value of the bond, sometimes called its par value.[2] X Research source Note that this value might be (and probably is) different from what you paid for the bond. It's given to you by your broker.Step 2, Locate the bond expiration. You'll also need to locate the bond expiration or maturity date.[3] X Research source That way, you can get a sense of how long you'll be receiving coupons and when you can expect ...

What is a Coupon Rate? - Definition | Meaning | Example In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80. So, Georgia will receive $80 interest payment as a bondholder.

Coupon Rate - Meaning, Calculation and Importance - Scripbox Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. Coupon Rate = (Total Annual Interest Payments / Face Value of the Bond) * 100 Let's understand couponrate calculation with the help of an example.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of...

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05%

How to Calculate a Coupon Payment | Sapling Twice-yearly equal coupon payments. If your security's par value is $1,000, and you receive two coupon payments of $25 each, your annual payment is $50 ($25 x 2 payments each year). Your coupon rate is 5 percent: $50 (total annual coupon payment) divided by $1,000 (par value) x 100 percent.

› playstation-userbasePlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ...

How to Calculate Bond Discount Rate: 14 Steps (with Pictures) - wikiHow Calculate the bond discount rate. This tells your the percentage, or rate, at which you are discounting the bond. Divide the amount of the discount by the face value of the bond. Using the above example, divide $36,798 by $500,000. $ 36, 798 / $ 500, 000 = .073596 {\displaystyle \$36,798/\$500,000=.073596}

Coupon Rate: Definition, Formula & Calculation - Study.com The coupon rate is the annualized interest also referred to as the coupon, divided by the initial loan amount. The initial loan amount is the par value. In the example given, the coupon rate is ...

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Formula: Coupon Rate = (Coupon Payment × No of Payment) / Face Value Finance Calculators Active Return

How To Determine Discount Rate - couponuu.com How to Calculate Discount Rate in a DCF Analysis. CODES (6 days ago) How to Calculate Discount Rate: WACC Formula. The formula for WACC looks like this: WACC = Cost of Equity * % Equity + Cost of Debt * (1 - Tax Rate) * % Debt + Cost of Preferred Stock … Visit URL. Category: coupon codes Show All Coupons

How to determine a new bond's appropriate coupon rate I start with a bond issue's par value, YTM, and desired price. I then determine the appropriate coupon rate.==I'm a Finance Professor at the University of Te...

What is 'Coupon Rate' - The Economic Times The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 per cent, you will get Rs 200 every year for 10 years, no matter what happens to the bond price in the market.

What Is a Coupon Rate? - Investment Firms Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. For instance, say a bond has face value of $2000 and a coupon rate of 10%. Therefore, it pays $200 every year no matter what ...

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset The coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or "par value") of the bond. For example: ABC Corp. releases a bond worth $1,000 at issue. Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value:

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

› work-usaid › resources-for-partnersINDIRECT COST RATE GUIDE FOR NON-PROFIT ORGANIZATIONS Determine Indirect Cost Rate Structure: Determine which method is best for the organization, i.e., direct cost allocation or simplified, and whether special indirect cost rates are required, i.e. on-site, off-site, fringe benefit rate for full-time vs. part-time. In selecting the appropriate method, the organization should consider the following:

How To Determine The Discount Rate Coupon, Coupon or Promo Codes Big coupon code, coupon code, promotion code, discount code. 159.223.93.251 . Coupons Codes; Promo Codes; Top Deals; Top Searched; Top Stores; Coupons Codes; ... How To Determine The Discount Rate; How To Determine The Discount Rate. OFF. Assignment Essays - Best Custom Writing Services

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if...

Post a Comment for "42 how to determine coupon rate"